Calculate ltv home equity loan

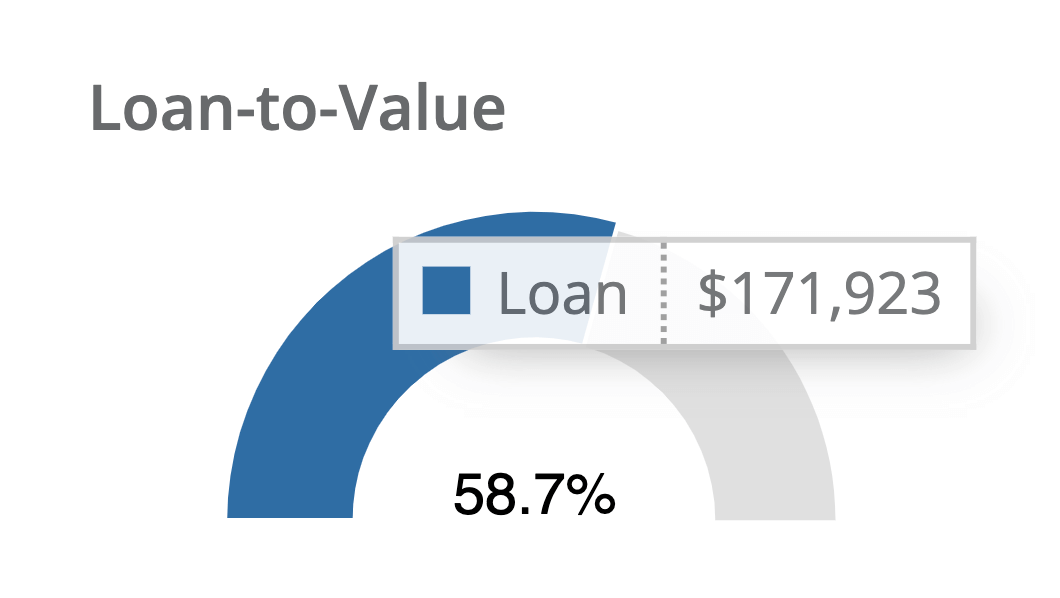

It will also display your current loan-to-value LTV ratio which is a metric lenders use. Use Your Home Equity Get a Loan With Low Interest Rates.

What Is The Loan To Value Ltv Ratio For A Mortgage Freeandclear Mortgage Lenders Mortgage Process Mortgage Loans

140000 200000 70 Convert 70 to a percentage which gives you a loan-to-value ratio of.

. To figure out your LTV ratio divide your current loan balance you can find this number on your monthly statement or online account by your homes appraised value. Take what you want to borrow or already owe and divide by the value of the property. Use this calculator to determine the home equity line of credit amount you may qualify to receive.

Then subtract your mortgage balance and any loans secured by your homelike a home equity. Get The Cash You Need To Pay For Whats Important. If you put 20 down on a 200000 home that 40000 payment.

Skip The Bank Save. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice. Yes its the flip side of.

The calculator will estimate how much you might be able to borrow through a HELOC. In this example you want to refinance. Your home currently appraises for 200000.

To calculate your homes equity divide your current mortgage balance by your homes market. Ad Give us a call to find out more. Ad Top 5 Best Home Equity Lenders.

To calculate home equity percentage first get the equity by subtracting the amount currently owed in mortgage loans from the current appraisal value of the home. 2022s Best Home Equity Loans. The amount of equity available for a home equity loan or line of credit is determined by the loan-to-value ratio of the home.

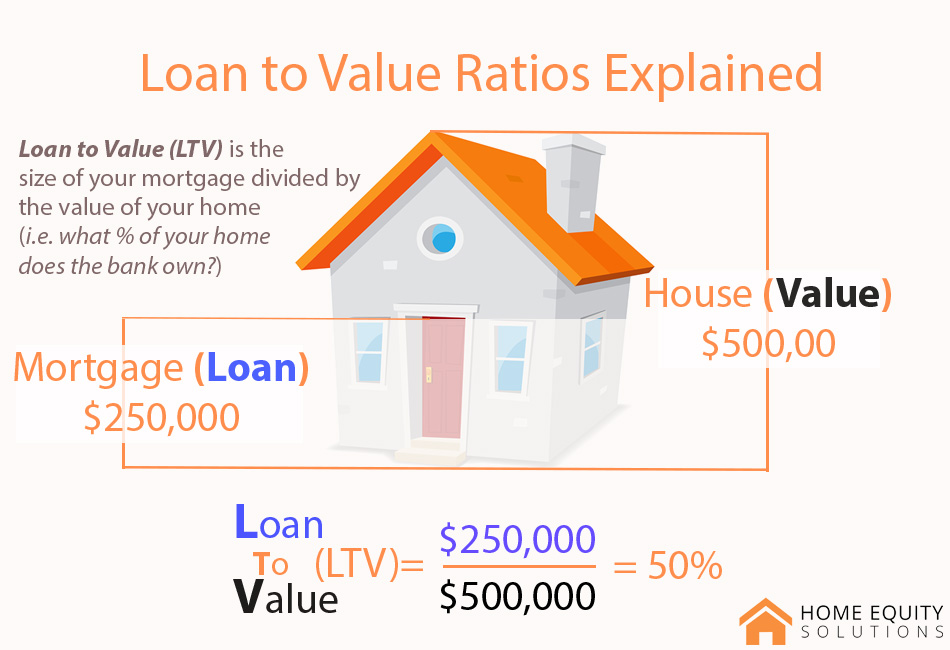

Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. Home equity loans typically have a closing cost ranging between 2 and 5 of the amount borrowed. The line of credit is based on a percentage of the value of.

For as many as four lender loan-to-value ratios this calculator will help you figure out the credit line you may be able to secure. So your loan-to-value equation would appear as. How to work out the LTV This is a simple calculation.

This would mean that if you borrowed 50000 you might expect to pay. It is calculated by dividing the remaining loan balance by the current market value. LTV Home Equity Loan Calculator This calculator will estimate how large of a credit line you may be able to qualify for for up to four lender Loan-to-Value ratios percent of value of home a.

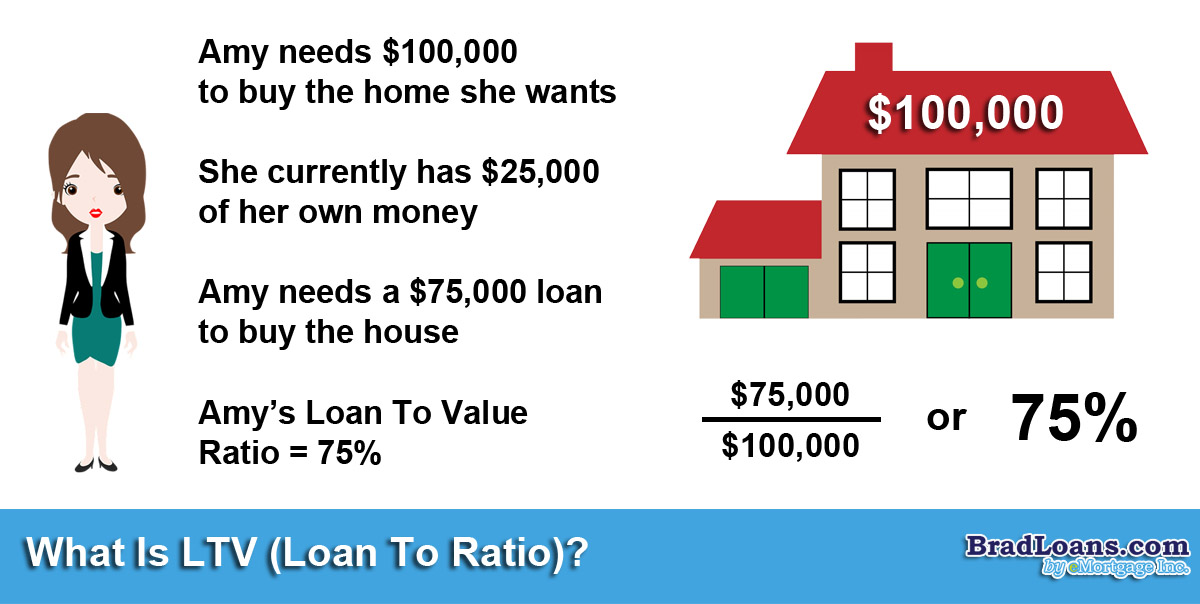

This is best shown by way of an example. Put Your Home Equity To Work Pay For Big Expenses. How do you calculate a home equity loan.

Are you thinking about taking out a home equity loan. Compare Mortgage Payment Options. With your current mortgage loan balance at 110000 you have 90000 worth of equity in your home.

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. If youre not sure how much youre. Refinance Before Rates Go Up Again.

Dont Wait For A Stimulus From Congress Refi Before Rates Rise. To determine how much you may be able to borrow with a home equity loan divide your mortgages outstanding balance by the current home. Ad Monthly Payment Calculations.

Use this calculator to estimate your home equity loan payment in four steps. Use Our Comparison Site Find Out Which Lender Suits You The Best. Ad Compare All Your Equity Options in 1 Place.

Ad Put Your Equity To Work. If you want to borrow 50000 of that through a home equity loan your CLTV would be. Here is how to calculate your LTV.

Using the second example described above your LTV is 78. This is the amount you want to borrow. Which Option Is Right For You.

Ad Update Your Home Or Pay Down Debt - Make It Happen With A Cash-Out Refinance From Chase. Enter your loan amount. The percentage value is.

Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. Multiply by 100 to. Save Time Money on Your Loan.

Lenders typically require that you have between 15 percent and 20 percent equity in your home. 303000 new loan balance divided by 500000 value 61 LTV ratio Refinance cash-out LTV ratios. Ad 2022s Best Home Equity Loans Comparison.

To calculate your LTV ratio using Microsoft Excel for the example above first right click on columns A B and C select. To find out how much equity you have first get the most recent appraised value. Tap Into Your Homes Equity Without A HELOC.

Using Excel to Calculate the Loan-to-Value LTV Ratio. Ad Give us a call to find out more.

Information On 125 Ltv Home Equity Loans Mortgage Refinance Refinancing Mortgage Information Mortgage Mortg Home Equity Loan Home Equity Second Mortgage

The Easiest Way To Calculate Ltv Potential For Your Ecommerce Business Recharge Payments

Loan To Value Ratio Ltv Formula And Example Calculation

I Would Love To Help You With Your Financing Call Me Today Mortgage Refinance Firstimehomebuyer Jumbo Purchase Home Mortgage Mortgage Payoff Mortgage

Na Zgomvhygwqm

How To Calculate Your Loan To Value Ratio Finder Com

What Is 100 Ltv Home Equity Loan How Does It Work Mortgage Refinance Company

Information On 125 Ltv Home Equity Loans Mortgage Refinance Refinancing Mortgage Information Mortgage Mortg Home Equity Loan Home Equity Second Mortgage

Loan To Value Ratio Ltv Formula And Example Calculation

What Is A Loan To Value Ratio Or Ltv And Why Does It Matter Stessa

What Is Ltv Loan To Value Ratio Brad Loans By Emortgage

Understanding Loan To Value Ltv Ratio In Cre Leverage Com

How To Calculate Your Home Equity Finder Com

What Is Harp And Do I Qualify For A Harp Loan Refinance Mortgage Refinancing Mortgage Mortgage Tips

How To Calculate Loan To Value Ratio Formula Excel Example Zilculator Real Estate Analysis Marketing

Loan To Value Explained Home Equity Solutions

How To Calculate Your Loan To Value Ratio Ltv Finder Uk